Finpace: Turnkey neobank software solution for Africa

African finance is undergoing a rapid digital transformation, and Finpace provides the compliant, enterprise-grade core banking technology required for institutions to build and scale next-generation neobanks. This white-label platform enables financial institutions and fintechs across key African markets to rapidly deploy secure digital banking experiences, shifting strategic focus from infrastructure management to sustained innovation.

Trusted by African companies

Neobank core platform built for african realities

Finpace is the comprehensive white label core banking platform engineered for African market realities, serving institutions in Nigeria, Kenya, South Africa, and beyond. It allows banks and fintechs to rapidly build and scale secure, hyper-local digital banking experiences.

Our enterprise grade platform includes critical regional features like cash in/out via agents, integrated bill payments, direct Mobile Money interoperability, and robust USSD capability. Finpace unifies these features with core accounts and compliance into a single flexible ecosystem, shifting focus to innovation, not infrastructure.

Proven success across diverse markets

In the dynamic African financial landscape, a proven track record is not a luxury; it is the fundamental assurance of stability, compliance and functionality. Finpace is a battle tested neobank core operational across several markets including Sierra Leone, Kenya, Nigeria, Mauritius, Lebanon and Ghana. This multi jurisdictional presence means the platform has navigated complex regulations and scaled to serve millions of end customers. This history of high volume continuous operation provides clients confidence that Finpace will perform reliably in their specific market context.

Finpace goes beyond selling software. We partner with institutions providing the essential expertise and tools required to achieve market success. Deployments across such diverse nations underscore the platform’s unique adaptability handling high volume mobile money transactions and complex regional compliance. Clients gain a platform embodying years of practical knowledge and strategic intelligence necessary to rapidly build, launch and scale a successful next generation digital bank.

Finpace overview

Reimagining the core of modern banking

Built for scale and agility, Finpace provides the transactional backbone institutions need to operate seamlessly and connect with today’s digital finance networks.

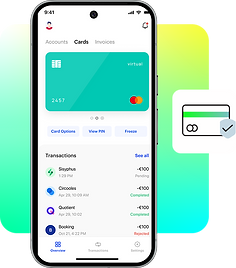

Card issuing and management

Finpace enables institutions to issue and manage physical and virtual cards under their own brand, seamlessly connected to core accounts and integrated with Visa, Mastercard, and UnionPay networks.

Accounts

Finpace enables institutions to create and manage customer accounts in both local and multiple currencies, providing real-time balance updates, transaction visibility, and seamless integration with payments and card services.

Agent banking

Finpace enables institutions to onboard, manage, and monitor agents through a centralized portal, supporting hierarchy structures, commission tracking, and real-time settlement across distributed agent networks.

Crypto and digital assets

Finpace offers optional crypto modules that enable institutions to provide customers with secure, compliant access to hold, send, and exchange digital assets alongside fiat accounts, with configurable controls to meet evolving regulatory requirements across markets in Africa.

KYC

Finpace provides a comprehensive KYC module that enables institutions to verify customer identities through document checks, biometric data, and third-party integrations, ensuring compliance with AML and regulatory standards while maintaining a smooth digital onboarding experience.

Microloans

Finpace enables institutions to originate, disburse, and manage microloans through an integrated workflow that supports Murabaha and other Sharia-compliant financing models, ensuring transparency, timely collections, and full regulatory adherence.

Seamless integrations

Banks & BaaS

Finpace supports seamless integration with sponsor banks and Banking-as-a-Service (BaaS) platforms to enable institutions to issue accounts, cards and process payments under their own brand.

Mobile Money

Finpace connects to leading African mobile money providers (including M‑Pesa, MTN MoMo, Orange Money, Airtel Money and Wave) to enable interoperability between digital accounts and cash ecosystems.

FX & Remittance

Finpace integrates with currency exchange and cross-border remittance networks to facilitate fast, compliant transfers and multi-currency settlements for international flows.

Cryptocurrency

Finpace connects to external digital-asset liquidity pools and custodial services to enable institutions to offer crypto wallets, asset holding and exchange capabilities in parallel with fiat account infrastructure.

Build the future of banking in Africa

Digital banking has become the benchmark for institutional excellence. Finpace provides the technology, security, and flexibility that enable financial institutions to operate with confidence, deliver innovation, and lead in a rapidly evolving market. Whether establishing a new digital bank in Nigeria, developing a card ecosystem in Kenya, or expanding multi-currency operations across South Africa and Ghana, Finpace serves as the foundation on which the future of African banking is built.

Sharia-compliant banking

Our software supports all banking operations and transactions in full alignment with Sharia principles, ensuring ethical, transparent, and compliant financial practices.

Flexible delivery models

Our clients

Banks and microfinance organizations in Africa

Finpace supports financial institutions across Africa in modernizing their banking operations and expanding digital access. Designed for both retail and corporate clients, Finpace provides a unified platform that streamlines processes, enhances customer experience, and ensures compliance with regional regulatory frameworks.

Why Finpace?

End-to-end delivery

Finpace goes beyond software deployment by combining advanced technology with market expertise, supporting institutions through every stage of product design, implementation, and growth to ensure sustainable success.

Global Presence

Operating across the EEA, the Americas, the GCC, and Africa, Finpace applies global best practices and regulatory insight to help institutions maintain technological leadership and operational excellence in every market.

Local partnerships

Finpace collaborates with a strong network of regional partners and established financial institutions, providing new clients with proven local expertise, shared resources, and a foundation of trust across key markets.

“Finpace moved us from manual processes to real-time lending in a matter of weeks, with no additional hiring and full control retained.” - Marcus Bennett, CFO Vult Capital

Technology engineered for scale

Finpace is a modular, white-label banking platform designed to grow with your institution, combining flexibility, security, and compliance within a single scalable technology layer that adapts to your evolving business needs.

Let’s build the future of banking together

Whether you’re scaling what works or starting something new, we’re here to help. Book a discovery session and explore what’s possible with Finpace.